Is a lack of physical infrastructure holding India back? Yes – and no.

While the physical amount of key elements of infrastructure in India benchmark well internationally, the on-the-ground perception for many is that its infrastructure is vastly deficient.

To see if this paradox could be resolved, we studied both the quantity of infrastructure in place and the quality of that stock.

The answer is nuanced.

India needs more infrastructure in some key sectors and better quality in others. Either way, the demand on public and private sector balance sheets to finance the required investments in greenfield projects and upgrading activities will be considerable. So too will be the associated demand for steel – with infrastructure demand expected to increase at an approximate rate of 8%, compound, between 2016 and 2025.

Does India just need more infrastructure?

India’s infrastructure has been much maligned, with descriptions such as ‘insufficient’ freely dispersed by both local experts and international observers. Popular consensus would imply that what the nation has achieved to date, such as halving the country’s poverty rate since the early 1990s1, has been achieved despite its infrastructure.

On a per-unit land area basis, the volume of India’s transport infrastructure looks respectable. So why is the positive impact of these apparently expansive networks not being felt?

Our research brings a new perspective to the discussion. It is true, India’s infrastructure stock has many gaps. But to fully comprehend the challenge, we must differentiate between quantity shortfalls (i.e. simply not enough stock in place for efficiency’s sake) and lack of quality (i.e. simply not good enough to be internationally competitive).

India’s cumulative road network is 5.5 million kms long, the second largest in the world. That is despite having only the 8th largest land area. The nearest comparable networks are that of the US (6.7 million kms) and China (4.6 million kms). Note that both countries are approximately three times larger than India in terms of land area and have much higher rates of auto penetration. Similarly, India’s railway network is the 4th largest in the world at over 67,000 kms long, with only the US, China, and Russia (five times larger than India in land area) standing ahead of it.

On a per-unit land area basis, the volume of India’s transport infrastructure looks respectable. So why is the positive impact of these apparently expansive networks not being felt?

Why quality counts

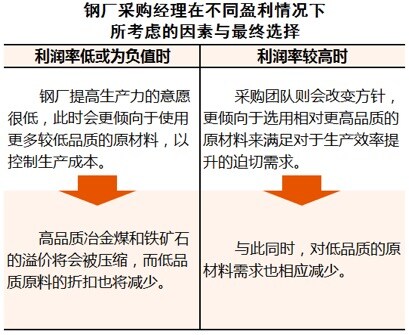

The benefits of having an internationally competitive infrastructure base are self-evident. For India, increasing the quality of the integrated international logistics chain, and the quality of the integrated domestic logistics chain, would have two profound benefits. On the domestic chain, an enormous prize awaits in terms of reducing ‘needless’ food waste2. This would be of tremendous benefit to the entire population, particularly its economically insecure rural population. Increasing the quality of integrated inward logistics will also support India’s ability to leverage its comparative advantages, allowing domestic resources to flow to their most productive uses. In the specific case of commodities, such as those produced by BHP, India lacks a large, high quality metallurgical coal endowment. Slow and costly logistics from port to mill though act as a constraint on some elements of India’s blast furnace fleet from accessing the best quality raw materials at an internationally competitive delivered price. For India’s steel industry to reach its true potential, competitive access to the best quality seaborne raw materials should play a major part – just as it has done in Japan, South Korea and China.

With that in mind, let’s turn to the quality discussion.

Of India’s total road network is 40% unpaved. The share of expressways in the overall road network is negligible, while national highways are less than 3%. That compares to around 40% in China. Of the highways that do exist, almost 75% are two-lanes wide or less (considering both sides of traffic flow). This drastically reduces not only the amount of traffic the network can handle, but also the ease of traffic movement. The nation’s road network, for its impressive length, is not presently capable of serving as the commercial logistics backbone of the continent-sized mega-market India aspires to be.

We anticipate an approximate 8% per annum compound growth rate for steel use in Indian infrastructure out to 2025.

In railways, the transition from narrow to broad gauge is only just being completed. Almost two thirds of the overall route length consists of single-lines. Less than half of the network is electrified, while large sections of tracks are near end-of-life and require significant maintenance. These factors remain a major drag on the efficiency of the network. The average speed of passenger and goods trains is constrained to 60 kmph and 25 kmph respectively. With the interaction between quality gaps in the road network, and quantity and quality gaps at sea ports, you have a logistics system that is not internationally competitive in terms of domestic commerce, imports or exports.

Once the quality of transport infrastructure is considered, the paradox of globally competitive size of networks coupled with to perceptions of inadequacy, is effectively resolved.

The graphic below details our estimates of the size and distribution of the quality and quantity gaps across the major infrastructure segments, alongside our mid-case view on the development of steel demand across all end-use sector.

We anticipate an approximate 8% per annum compound growth rate for steel use in Indian infrastructure out to 2025.

India’s infrastructure gaps and steel demand

Infrastructure development: from historical dissonance to contemporary coherence

The contradictions observed in Indian infrastructure are not a coincidence. They are the result of decades of political and bureaucratic incongruence in terms of infrastructure planning and development. A lack of coordination across levels of government allowed for an inefficient combination of project specific planning approaches, isolated project evaluation and top-down execution systems to co-exist. In addition, the complexities of land acquisition, clearances and approvals, project funding, state-federal grey areas, and a politicised infrastructure construction process resulted in significant inflation of cost and timelines. This has created a geographic and industrial distribution of infrastructure that produced pockets of progress (such as the heavy industrial cluster that rose up in Gujarat under then-Chief Minister Modi) sitting side by side with pronounced gaps across other regions, states and sectors.

Reforms to address the underlying causes of these historical issues have been initiated. The Modi-led government, with its pro-development agenda, has sought a more direct approach to planning and development. With planning more centralised, it complements the development of a strategic long-term national vision, taking into account an integrated view across sectors. The ‘Bharatmala’ program for highways and roads, ‘Sagarmala’ for ports and the ‘National Rail Plan 2030’ are three concrete examples.

In parallel, there are efforts to decentralise project execution to improve efficiency. This will include increased outsourcing and greater private sector participation.

These encouraging signs are an excellent start on the path to realising India’s long run economic potential. Realistically of course, it will take some time for these changes in planning and execution methodology to trickle down through India’s elaborate bureaucratic machinery and translate to discernible impacts on the ground. Count us as cautiously optimistic.

1 Based on World Bank data, India’s headcount poverty ratio has declined from 45.3% in 1993 to 21.9% in 2011 (the last available data).

2 http://www.fao.org/save-food/projects/study-fl-india/en/

(https://www.bhp.com/media-and-insights/prospects/2018/07/the-paradox-of-indias-infrastructure)