In the early days of starting up my company Smart Books Online (SBO), I had no idea what I was doing.

Ok, I knew how to do the technical work, but I had no idea of what my ‘ideal customer’ looked like.

Accordingly, when it came to engaging new clients — I wasn’t fussy.

I needn’t care who they were, as long as they had money to pay me. I was just focused on sales to make payroll.

The challenge with business, particularly in the early phases of starting a new venture, is that it’s very difficult to say ‘no’. You take every meeting, every phone call, every bit of work that comes your way.

Even if you know in your heart and on paper that you might just break even or even lose money on a customer or project, you’ll say yes because you never know, it may lead to something bigger.

My newly formed habit of being a ‘yes man’ proved to be completely flawed as my business grew rapidly, from a revenue perspective anyway. Although sales were growing, we were losing money. Profit margins were getting squeezed due to discounting to win work.

Furthermore, due to misaligned client expectations, service declined. Customers were getting frustrated and were churning. As a result, I was losing more customers than I won. My financial and mental health was suffering as a result.

I was slaving away — 14 hours a day, 7 days a week, feeling overwhelmed and too busy to realize what I was doing wrong.

I mean, it could have been okay if I was profitable, but the truth was that I wasn’t. From a revenue perspective, I was crushing it. My business was consistently doing 20% month-on-month revenue growth (which is impressive growth for any business, irrespective of industry or size).

The problem, however, was while top-line revenue was growing, I was actually losing money. I was servicing unprofitable customers. I hadn’t designed a process on how to service our customers consistently, and profitably.

I was stuck in a profit losing machine of my own design, relentlessly spinning cogs.

I was trapped.

Higher thinking

With the business spiralling out of control, something had to change.

My business partner and I spent a Sunday afternoon taking time away from the business and objectively analyzing it. We wore our ‘business owner’ hats and assessed our financial performance.

What we unearthed validated our gut feel assumption: Our business was a disaster.

The irony was that while we were supposed to be helping our customers with their firm’s financial performance, I couldn’t even do it myself.

“How ironic,” I thought to myself. I felt like an imposter.

Quickly snapping myself out of an emotional state, my rational brain got to work: Starting with a customer profitability analysis.

In our analysis, we discovered that the profit generated by the top 20% of our customers were absorbing the losses of the bottom 80%.

In other words, we were suffering because we were not selective about our ideal customers.

Being a yes person was killing our business.

Chances are, it’s also killing yours.

A practical guide to analysing the profitability of your customers

Here’s a step by step guide of how we undertook our customer analysis. I’ve tried my best to document all the steps, but if you get confused or lost — feel free to reach out.

Step one: Export a sales report

Export a sales report from your accounting system to a spreadsheet. Filter this data by customer name and dollar value of sales for the last 12-month period.

Step two: Ask questions

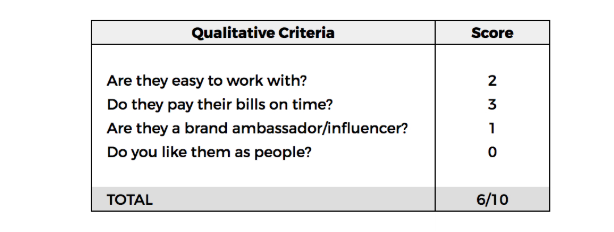

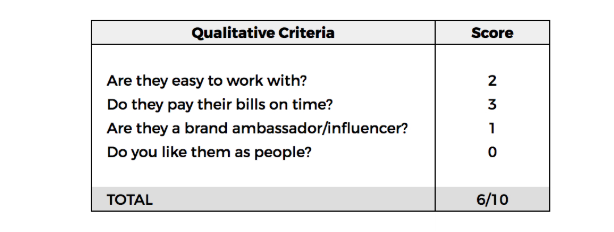

For each customer ask yourself the following questions:

- Are they easy to work with?

- Do they pay their bills on time?

- Are they a brand ambassador/influencer to your product or service?

- Do I like them as people?

For questions one, two and three, assign a score out zero to three (zero being terrible, three being amazing).

For the fourth and final question, make that it binary. Either a zero or one.

Tally your results, which will give you a qualitative score out of ten for each customer.

Example:

The process of allocating a score against each question helps you to assess your customers objectively. This quantification serves to eliminate any biases you have to your customers.

Step three: Calculate the direct cost

Calculate the average direct cost to service each customer and enter the value in a new column. You can allocate this off your timesheet data or project management system.

Step four: Calculate the gross profit

Calculate the gross profit earned on each customer by deducting the average costs to service each customer from the sales dollars.

Step five: Sort your customers by gross profit

Filter the spreadsheet by gross profit of each customer and rank them per step two. The result is a list of your most profitable, desirable customers. They’re the ones you want to clone. And, at the bottom of the list, are the ones you want to cull.

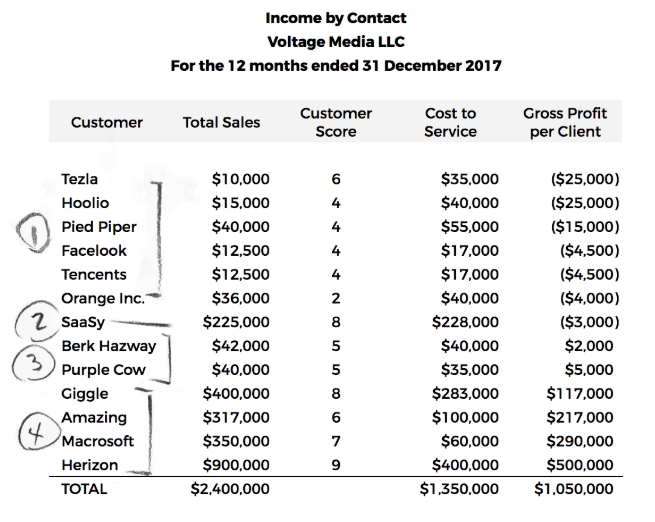

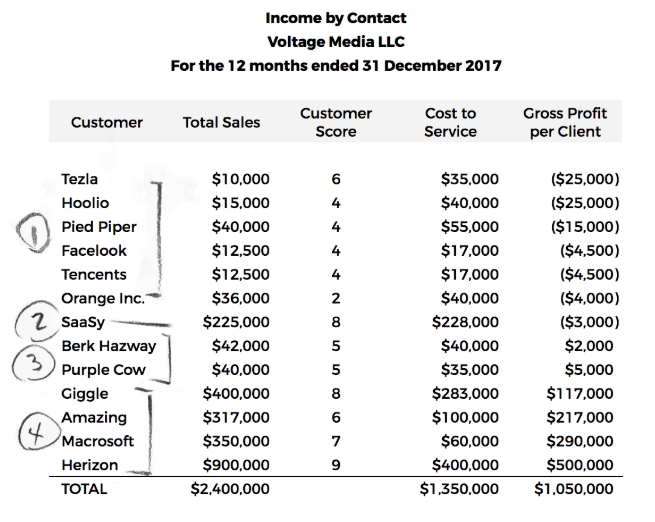

The table above is a sample customer profitability analysis for a fictitious company called Voltage Media.

Here are the key observations:

- The customers under note one are the customers you should fire. They rank low on the qualitative customer score, and they are loss-making. Fire them quickly.

- The customer SaaSy under note two is less binary. This company brings in a lot of revenue and is ranked highly on the customer score. However, it is being serviced unprofitably. It’s fundamentally a great customer to work as it’s ranked eight out of ten, but ultimately, you cannot continue to service them profitably. In situations like this, dig deeper to understand why this client is unprofitable. Perhaps because you’re over-servicing them or not producing their work efficiently? Use this as a prompt to unearth the underlying issue.

- The customers under note three are fence sitters. They rank in the middle from a customer perspective, and they generate a small profit to the business. You’re ok to hang on to these customers, but keep track of how they rank in the future.

- These customers rank highly on the customer score and bring in the most profit to the business. Notice how the profit generated from these four clients carry the losses of the bottom half? These are the customers you want to replicate.

How to sack your customers

In the 24 hours that followed our customer analysis, I made several simple, but emotionally difficult decisions that literally changed my business. I took steps to fire the unprofitable 80% of my customers.

My outreach email was something like this:

Me: Hey customer, I’m reaching you to inform you of a few internal changes at our company. We’ve spent the last 12 months servicing our customers of all shapes and sizes, from startups to larger businesses. To date, we’ve been flexible to cater for all these different businesses as we want to help as many businesses as possible. As you can appreciate, being tailored for everyone does come at a cost. After reviewing our service offering and the associated fees, we are changing our prices. Your account will fall into the new package at $XX per month. I can appreciate this comes at a higher price, and this investment will ensure we’re able to continue to maintain our level of service.

Please reach out if you have any thoughts on the above. If I don’t hear from you in the next ten days we’ll assume you’re comfortable with the new arrangement.

Customer: I must say it is not an appealing proposition at all. As we have always been dealing with this issue fail to see what is different now and more surprising how it can double the monthly cost of the service you provide to us.

Me: I agree nothing has changed since engaging us, however our recent review showed we cannot service you profitably at the current rates. I hope you appreciate this doesn’t make business sense for us. I can refer you to a cheaper alternative if you wish. Let me know and I can make the introduction.

As expected, a handful of customers left us with and were happy to accept our referral recommendation to another service provider.

What we didn’t expect however was that the majority of customers accepted the price increases, and continue to be customers of ours today.

Giving your customers clear options to either pay a higher rate or, be referred to a cheaper alternative makes the decision binary, leaving no room for time wasting negotiations. Make the decision easy for your customers. They are busy people as well.

The net result was that we actually increased revenue because the price increase offset the churned, unprofitable clients. Making the decision cull these bad customers built a platform to maintain efficient and sustainable longer-term growth.

Although we had fewer customers, we were more profitable at a gross profit level, had more time and were most importantly, less stressed.

As business owners it’s easy for us to get stuck in the trenches, feeling overwhelmed and stressed with the state of your business. If you want to grow but not sure what to do start by reviewing your current customers.

Indeed, it sounds counterintuitive to sack customers in order to grow revenue and profitability.

But, to move forward, you need to start by getting your house in order.

This is an excerpt from Jason Andrew’s book, Stark Naked Numbers: Uncover Your Financials, Unlock Your Cash, and Unleash Your Profits, which launches on the 21st of January 2019.