The fourth sales trend from the Barrett 12 Sales Trends Report for 2018 is about buyer behaviours and the future of sales roles.

According to Gartner Research, by 2020 85% of interactions between businesses will be executed without human interaction.

Automation has already diminished the number of people required for blue collar manufacturing roles; however, with the advent of AI (artificial intelligence), big data and algorithms, we are beginning to see sweeping changes happening across the once untouchable white collar sector, including the very people-oriented roles of sales, as many buyers shift part or all of their buying journey online.

This is really worrying people and creating lots of uncertainty, and the reality is that people are at risk of losing their current roles.

This sales trend is focused on how buyers’ behaviours are changing with the rise of digital engagement and purchasing, and the impact this is having on sales roles across both B2B (business-to-business) and B2C (business-to-consumer) channels. But before we get into the details, not all is lost.

As this sales trend highlights, there is light at the end of the tunnel and not all roles are doomed. But these dramatic changes do require many of us to step up and really bring to the fore our very best human skills in communication, empathy, kindness, ideas generation, problem solving, creativity and delivering real value.

Remember, digital is still human powered

The irony is that everybody needs to know how to sell themselves to their colleagues, clients and suppliers. The skills excellent sales people possess and cultivate are the very meta-skills everybody needs today.

Professor Bronwyn Fox, director of Swinburne University of Technology’s Manufacturing Futures Research Institute, talks about the vital need for STEM (science, technology, engineering, maths) students and graduates to also be proficient in meta-skills (soft skills). This includes effective communication and the engagement of others to generate and share new ideas; the ability to bring innovations to market and actively engage; work with each other more effectively; and to sell themselves, their concepts and the future.

However, we are seeing a polarising of sales roles and we need to be ready to adapt.

When it comes to simple transactions, buyers expect to be able to do this type of purchasing online, free from human contact. However, as soon as the sales becomes complex, or less straightforward, buyers want access to real humans.

When it comes to human-to-human interaction, whether it be B2C or B2B sales, buyers are expecting a much more sophisticated response from organisations’ sales and customer care people.

Buyers want to deal with subject matter experts (SMEs), not sales people. So sales people need to become domain experts or work with their own SMEs to help buyers move forward toward their goal.

SMEs also need to learn how to sell. How do we make domain experts sales savvy? Back to the comments by Professor Fox, we need everyone to learn how to communicate and sell themselves effectively and ethically.

Let’s take a closer look at the trends and changes in the B2B and B2C channels.

Changes to the B2B buying and selling landscape

According to Andy Hoar at Forrester Research’s “Death of a (B2B) Salesman, April 2015”, 1 million sales people (22%) will lose their jobs in the US alone and one third of B2B order-taking sales jobs will cease to exist worldwide.

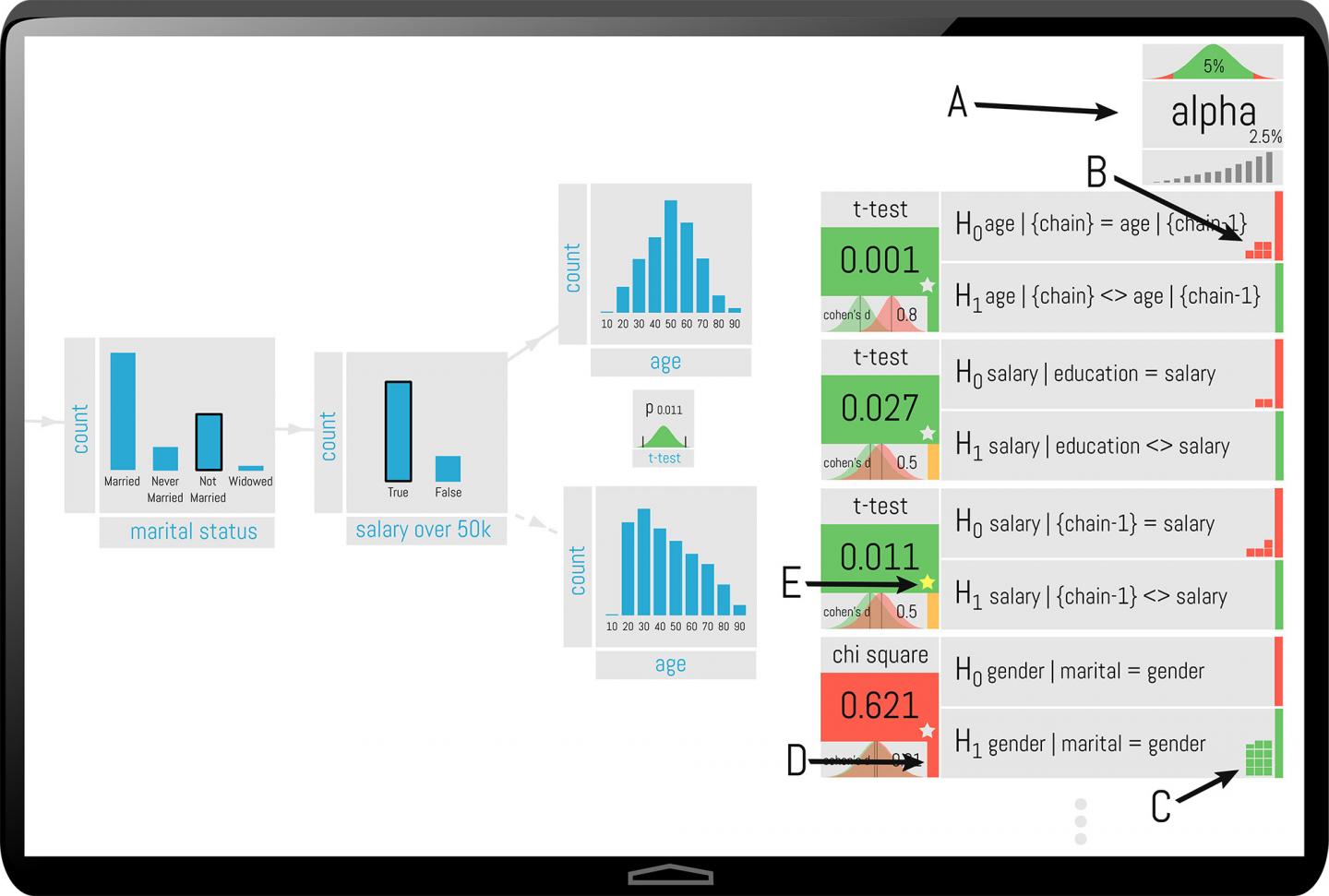

B2B sales job losses predicted by 2020:

- Order takers (transactional, socialiser, visitor): 33% job loss

- Explainers (tactical, hunter, warrior): 25% job loss

- Navigators (relationship, gatherer): 15% job loss

- Consultants (trusted advisor, politically aligned, add compelling business value): 10% job gain

B2B sales people must elevate to a higher plain if they are to survive. We are seeing a distinct shift away from generalist sales people to sales people becoming business and domain experts. Businesses are now needing their sales teams to transform into ‘domain experts’, or the hackneyed phrase ‘trusted advisor’, if they are to add any genuine value. This is now very evident across almost all types of business, having started with technical types companies first.

In B2B buying and selling situations, we are also seeing more and more stakeholders involved with the buying process, which is adding more complexity and time to each sales process. Coupled with this, we are seeing buyers buying in smaller amounts, adding further cost to the sales process and eroding margin.

The B2B buying and selling paradox

- Buyers have never been easier to identify but harder to engage and sell to;

- No one is lonely or bored, yet the value of genuine relationships is critical to effective buyer seller relationships;

- The average transaction is getting smaller but is taking longer to sell in; and

- 82% of sellers fail to differentiate themselves.

B2B buyers, like B2C buyers, are using omni-channels to research and make buying decisions. According to Forrester Research, 74% of business buyers conduct more than half of their research online before making an offline purchase. However, this does not mean they have not been in contact with sales people or that they have made a purchasing decision, especially if that decision is complicated and involves a range of people or processes. This is where effective B2B sales professionals can shine.

B2B sales people need to learn how to anticipate buyers’ needs and move beyond product and service. Smart companies are investing in their B2B sales people by helping them transition to human centred selling and business consulting.

Changes to the B2C buying and selling landscape

How are B2C buyers behaving?

British Telecom’s head of customer insight and futures in the BT Global Services Innovation Team, Dr Nicola J. Millard and her team, have been conducting extensive research over many years in B2C buyer behaviours and customer experience. Her latest findings reveal the following:

- Making digital experiences easy for customers delivers business growth; move over net promoter score (NPS) and bring on net easy score (NES);

- Businesses need to make it easier to do simple transactions, but as soon as it gets complicated they need to give their customers someone competent to talk to; there should always be a phone number so people can speak to a human being;

- Interestingly, autonomous customers rely on other consumers (not brands) for product advice;

- Chatbots have appeal – but with human agents checking on more complicated responses;

- Proactive service expected by digital customers;

- Smartphones are becoming more important in digital experience; and

- Providing security for phone transactions will drive revenue growth;

But beware the omni-channel

- Omni-channels shift human channels towards complexity;

- In times of flux people want simple, easy, straight forward. If it gets complicated they want to talk to a human being. Customers want “immediate access to a well-trained employee e.g. someone to talk to on the phone or face to face ….”, especially if there is a crisis and you need a solution to a problem with a product or service;

- Customers make decisions at each stage in the omni-channel journey based on their motivation, context and attitude; and

- In digital channels, it’s not so much about demographics anymore it’s about context

Context is driving omni-channel behaviours

Here are the new buyer profiles that are appearing online:

Visionary: They are looking to improve their lifestyle by the purchase of a product or service (e.g. moving house or booking a holiday). They are in a positive and motivated state of mind and willing to invest time. They may even enjoy the experience. They want businesses to let them explore, research and get advice using a wide range of resources (e.g. online, webchat, face-to-face/ in-store assistance).

Utilitarian: They want to complete a routine, mundane task (e.g. paying a bill or buying everyday products and services). It is low value in terms of their time, they are not looking for the ‘wow’ factor or enjoyment. Businesses need to make the transaction fast and easy (e.g. an app or online self-service technology).

Customer in crisis: There is a crisis and they need a solution to a problem with a product or service (e.g. reporting a fault or getting advice). They might be frustrated, angry or worried. Businesses need to give them immediate and straight forward access to a well-trained employee (e.g. someone to talk to on the phone or face-to-face who can sort the problem).

Finally, the phone is not dead

The telephone has been around since 1876 and is still as vital as ever. The telephone today supports the digital experience but it does need strategic attention.

When people cannot complete simple tasks online, when things get more complex, they want to talk to a person who doesn’t leave them stranded ‘on hold’ and has the smarts to be able to deal with their issues and questions. This is relevant for both B2B and B2C sales channels more than ever before.

In previous sales trends over the last few years, we have reported on the rise of, and need for, higher levels of complex sales and service capability on the telephone, with the move away from simple transactions and service outcomes.

The telephone needs to be staffed by subject matter experts who are well paid and capable of ensuring buyers have a great experience with our businesses. No longer the graveyard for expired field sales people or ‘pleasant’ customer service people, call centres are becoming ‘expert hubs’ working in concert with the field sales teams of domain experts and SMEs.

There is a great future for sales with selling moving to a high-order function that involves all, and buyers will be getting what they want too. Expert care and attention that builds trust and, hopefully, loyalty.

Smart companies will allow the buyer and selling pendulum to find its equilibrium.

Remember everybody lives by selling something.

NOW READ: Twelve sales trends for 2018: Welcome to the state of flux