During the last upswing in the commodity cycle, the incoming tide lifted all ships. But, to paraphrase Warren Buffet, now that the tide has gone out it seems to many investors that the mining industry has been swimming naked.

PricewaterhouseCoopers’ (PwC) Mine 2016 contains some sobering facts.

The PwC financial index for the top 40 miners (2015) shows earnings before interest, tax, depreciation and amortisation (EBITDA) at levels lower than during the global financial crisis (GFC).

During the upswing, miners took on substantial debt to increase production volume, but now the cash flow is not sufficient to retire this debt.

The financial industry has started to lose faith in mining companies’ ability to generate a decent return. This affects the availability and terms for obtaining equity and share capital.

And finally, it states: “Pressure will rise as attention turns to the next wave of productivity initiatives, which will have longer-term paybacks and require fundamental rethinking of structures, processes, systems, technology, organisational designs and capability needs. This is uncharted territory for the industry, at a time of rapid change in all sectors of the global economy.”

It is the authors’ opinion that this fundamental rethink has happened and is being applied successfully, even though the majority of the mining establishment is unaware of this.

Over the past 15 years we have observed a productivity intervention, delivering 20 per cent average output increase, in over 80 mine interventions, spanning Africa, South America and Asia.

This required limited or no capex, using no more than two consultants and within three to five months. The approach engages employees, and drastically reduces the cognitive load and pressure on mine management.

The impact of increased productivity on mine profitability

It is clear a turnaround requires drastic, sustainable productivity improvement. In a 2015 article titled: Productivity in mining operations: Reversing the downward trend, McKinsey showed that mining productivity had declined an average 28 per cent over the past decade.

From this, there would seem to be ample opportunity for improvement. Ernst and Young’s 2014 report: Productivity in mining: Now comes the hard part noted: “Executives see increasing productivity as their number one challenge, most are reducing cost and increasing volumes, but this has not affected the core productivity of miners.”

It is possible to make a conservative estimate of the impact of the productivity gap on the financial performance of miners by using the aggregate top 40 financials from the PwC Mine 2016 report.

According to this data, in 2015, if the top 40 could increase output by 20 per cent (using current assets), they would have delivered a 345 per cent increase in EBITDA.

This calculation assumes that sales value increase by 20 per cent, totally variable cost of production comprises no more than 50 per cent of the operational cost. Increasing supply would decrease pricing, but this would not be the case if a small fraction of mines improved to this extent.

Why is the mining productivity decline persisting?

A production system can be conceived as existing of three critical, interacting elements: technology, process and people.

Most productivity improvement efforts have focused on these elements in isolation, and in particular on better technology (automation, big data) or improving on process models. Strengthening and adjusting the linkages from these elements to the people link, and the people element itself have not received much attention.

Doing better than what we have always done will not deliver these results. Einstein said: “We cannot solve our problems at the level of thinking that caused them in the first place.”

The new paradigm requires a shift in the way the production flow process is designed and managed and strengthening of the link between production process flow and people behaviour. This drastically simplifies what needs to be done and allows managers and employees to coordinate horizontally, close to where the work is happening.

Eliminating variability and optimising all processes

Despite increasing knowledge around systems thinking and complexity, best practice in managing production flow in mining does not take these ideas into account.

Mining is different from most manufacturing systems in that the variability experienced is much greater and in that, the interdependence between production steps are tight, not only in space but also in time. Applying what works in manufacturing into mining should therefore be done carefully. Operational excellence, statistical process control, lean and the theory of constraints are all necessary, but not sufficient.

People aspects need to be integrated with all of these interventions. More important is that the prevailing management paradigm needs adjustment to do this integration well.

Systems thinker Russel Ackoff maintained: “If we optimise all the parts of the system then the overall system will not be optimised. And if we optimise the overall system then all the parts will not be optimised.”

And yet, with the help of ERP systems and budgets, the production flow through mines is constrained by trying to improve the local efficiency of every production department. The belief is that better planning and reducing variability will deliver better results – in this way we force certainty on what is inherently uncertain. This results in inter-departmental and hierarchical conflict, leading to unstable flow.

The consequence of this thinking is that we try to plan production with “just enough of everything”. In this way, we hope that we will achieve high efficiency on all the parts and thus achieve the greatest productivity for the system.

This is a fundamental mistake.

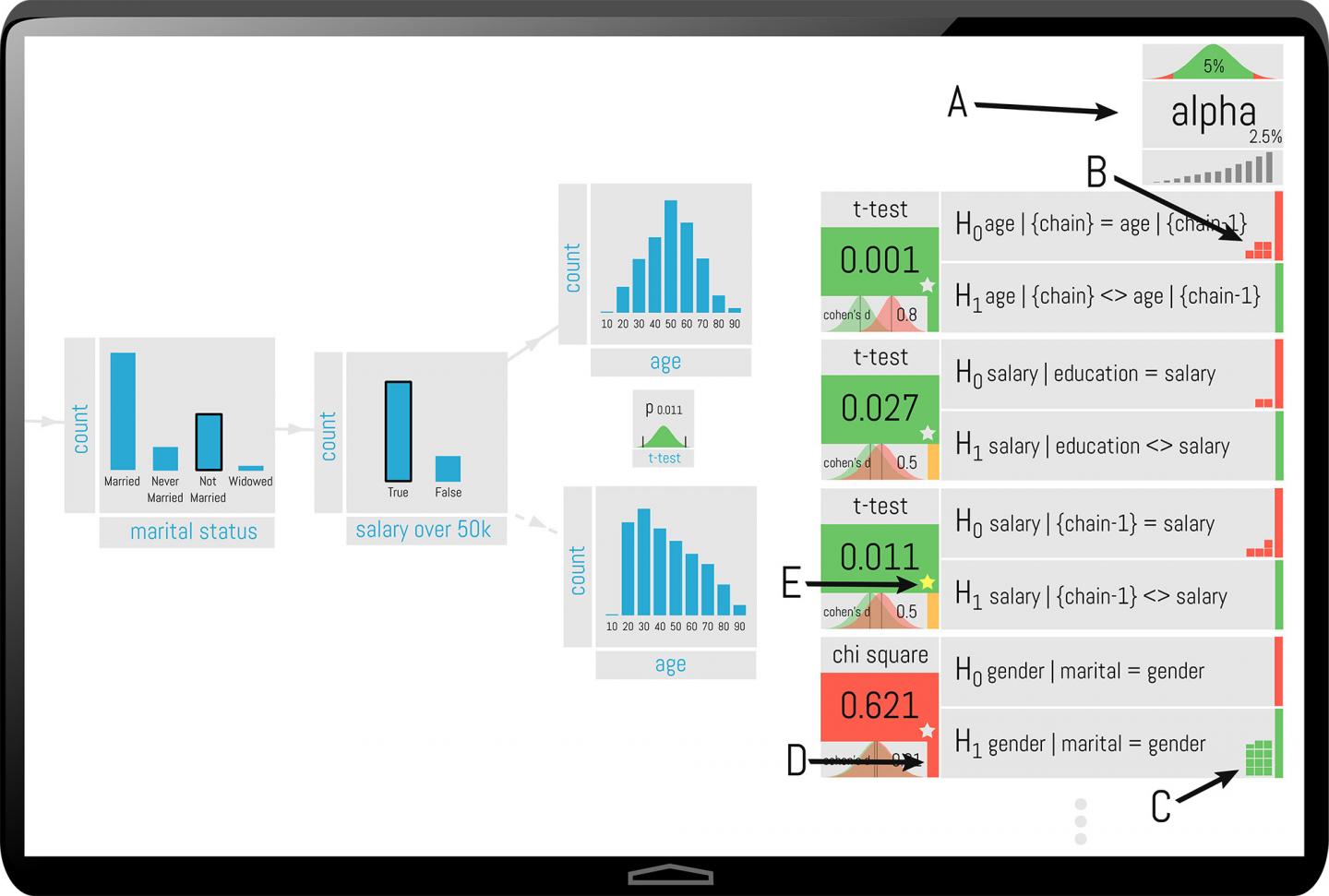

If we were to put together a set of six production units in sequence, each capable of delivering on average 10 units per hour, most observers would expect an average of 10 units produced every hour.

That would have to deliver 100 per cent efficiency in each process. But industrial processes do not follow a normal distribution.

Often a unit goes down and output is zero for that period. This unit blocks all the processes before and starves all downstream. For the time the unit is down no production occurs.

The unit sometimes produces 12, but then 0 now and then delivers 10 on average. The instantaneous output of the chain is always determined by the slowest production department – this gives us an overall chain which only produces five.

This important fact, which management is not aware of, creates tremendous pressure for mine personnel to improve. Often employee engagement is negatively affected.

In most chains one will find one production department with less capacity. This department should determine the maximum output achievable, and cause work to pile up here, but due to the dynamics described the bottleneck often seems to move.

This means that the flow is so unstable that output is significantly less than what the bottleneck department can deliver. This is where the lost output can be liberated.

A step change in mining productivity

Embrace variability and learn to manage it.

We have to identify the capacity bottleneck, put a material buffer in front and a space buffer behind and then ensure excess capacity in the other departments.

In this way, we can decouple the bottleneck from the rest of the system and replenish the buffers in time. Instead of focusing our attention on six departments we ensure that the bottleneck is resourced for maximum production and efficiency.

Other departments will work on not depending on the status of the two buffers. This simplifies production dramatically. The part in blue (see figure 1) is now added to the output, typically around 20 per cent of the total.

It is important to note that non-bottleneck departments in this example need to be resourced and run at 12 and 13 units capacity. This is to ensure that the buffers can be quickly replenished in cases where they have almost been depleted.

These departments will show a drop in their efficiency measurements, to the consternation of those tasked with measuring performance. It is crucial that change be allowed, only the bottleneck department needs to run at maximum efficiency, this requires a huge shift in thinking.

Reconfigure and strengthen the process – people link

A daily 30-minute cross-functional meeting is instituted. This is where the heads of departments, middle managers and selected employees get up-to-date visual information on what is happening to the production process (flow).

Colour codes identify where attention should be focused and where help from support functions such as HR and maintenance is required.

The productivity platform meeting provides visual feedback on the processes workers are responsible for and shows them how their actions affect the overall system and the outcomes.

It highlights problem areas in these processes and allows for dialogue in improving understanding of causes and actions to take. Management and workers simultaneously become aware of problems in the system, and restrictive policies and bottlenecks are addressed on the spot.

It is not possible to hide anymore – those not doing their part are visible to all. Peer pressure ensures that they rise to the challenge and start to support their colleagues.

Sometimes, as workers start to experience success, they become accountable and begin to volunteer their energy and talents. This reduces the load on management; they are not drawn into work which can be better performed by their employees.

A system of this nature was first implemented at Peabody Energy’s Warkworth mine in 1995 and yielded a productivity gain of 16 per cent in six months. In the past 15 years, further fine tuning has led to the development of a productivity platform which delivers a 10-50 per cent increase in output within three to five months.

Sustainability

The intervention is sustainable, provided the management team stays intact. After a few years of excellent performance, it is typical for the person that initiated the project to be promoted.

The new manager often lacks the context of the new paradigm and re-introduces standard industry practice. Output reverts to the level before the intervention. This points to the need for expanding the intervention to include top management. Otherwise, the intervention survives as an island of new thinking in a sea of old paradigms, eventually it will be submerged.

Summary

Miners are aware of the need for dramatic productivity improvement. When asked whether they are doing productivity improvement the answer is nearly always “we are doing this already”. The absence of substantial sustainable results suggests that something is amiss in these efforts.

The new approach flows from complexity science and systems thinking and pushes for greater effectiveness instead of greater localised efficiency. It does not attempt to force certainty (through better central planning) onto processes and interactions that are inherently uncertain.

It states that variability in mining is a given and needs to be managed, it cannot be eliminated. Centralised decision making must be relaxed and replaced with horizontally coordinated decisions close to the coalface.

We do this so that management maintains visibility of what is happening. In this way, we can empower and engage our employees without losing command of the situation.

This requires mine managers to embrace a new paradigm, which requires courage. But the reward to risk ratio is tremendous, a 20 per cent increase in output fundamentally affects mine profitability and the mine’s position on the cost curve.

This article was written by Stratflow Australia’s Hendrik Lourens. It was co-authored by Blakemore Consulting’s John Blakemore.